Why a Net Promoter Score is an Important Indicator of a Good Lender

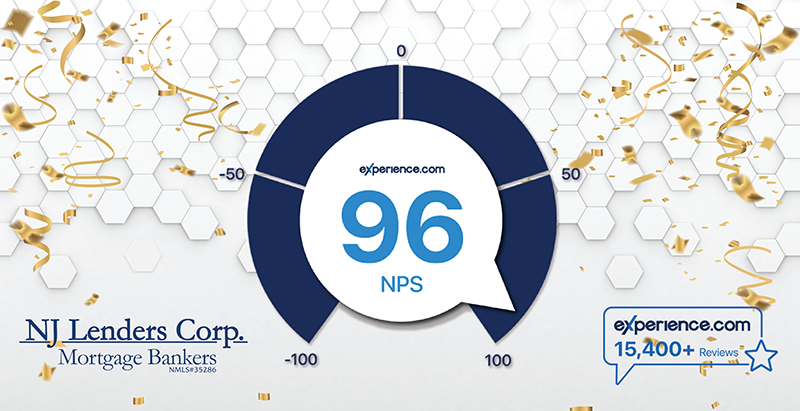

The best mortgage companies will gladly share their NPS, which is why NJ Lenders is pleased to announce that our company has secured an NPS of 96. By consistently placing the priorities and feedback of our clients at the forefront of our work, we are proud to be recommended for your mortgage needs. We sincerely thank our clients for their consistent loyalty and support.

The Net Promoter Score is a great way to anticipate your customer experience. Using the NPS as your guide, you’re more likely to choose the right partners during your homebuying process. Comparing each company’s NPS is important when choosing a mortgage lender. In 2019, J.D. Power reported that the average score for mortgage lenders is 16, one of the lowest of any industry studied by J.D. Power.

What is a Net Promoter Score?

The Net Promoter Score (NPS) is a way of quantifying those positive recommendations, giving you a powerful tool to evaluate professional service providers.

Used in customer experience programs, NPS measures the loyalty of customers to a company. Considered the gold standard of customer experience metrics, NPS measures customer perception and predicts business growth. First developed in 2003 by Bain and Company, NPS is now used by millions of businesses to track their customer satisfaction rates.

NPS scores are measured with a single-question survey and reported with a number from -100 to +100, with a higher score being more desirable. Consumers give a rating between 0 (not likely at all) and 10 (extremely likely) when determining how likely it is that they’d recommend a business to a friend or colleague.

- Depending on their response, consumers fall into one of three categories:

- Promoters respond with a score of 9 or 10, meaning they are loyal and enthusiastic customersPassives respond with a score of 7 or 8, meaning they are satisfied but not particularly excited

- Detractors, responding with a score between 0 and 6, are unlikely to work with a company again, and may discourage others from working with the company as well

To determine the NPS, one must subtract the percentage of Detractors from the percentage of Promoters. For example, if 100 surveys reflected 20% Detractors and 80% Promoters, the NPS would be 60.

Based on global NPS standards, any score above 0 is considered good, as it means that a company has more Promoters than Detractors.

Using NPS to Find a Trustworthy Lender

When you need a mortgage lender, choosing one with a high level of expertise and customer satisfaction is critical. But how can you decide? Many of us turn to our friends and family members for recommendations. When you know someone that has had a positive experience with a lender, it’s a strong sign that you’ll be in good hands.

The Net Promoter Score is a great way to anticipate your customer experience. Using the NPS as your guide, you’re more likely to choose the right partners during your homebuying process.